ACCA

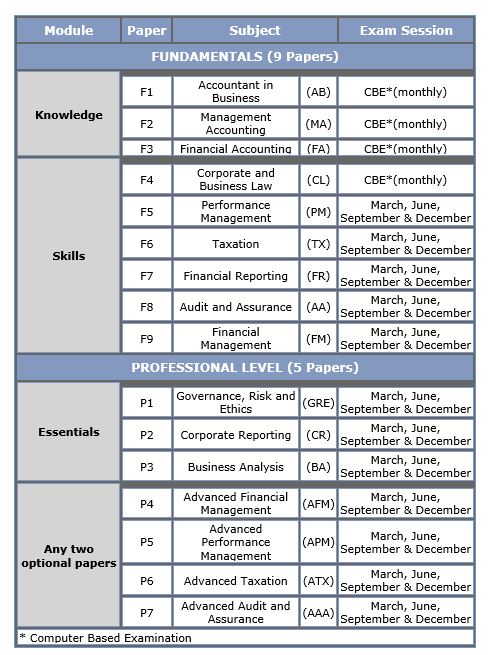

The ACCA Qualification is a highly-regarded accountancy qualification. In order to become a qualified chartered certified accountant and use the designatory letters “ACCA” after your name you need to complete:

- 14 exams (exemption can be claimed in nine exams)

- Three-years’ relevant practical experience requirements

- A Professional Ethics module

- A suite of awards, including certificates, diplomas and a revised Certified Accounting Technician (CAT) qualification – (Foundations In Accountancy)

- A Professional Qualification enabling members to reach the highest level in accountancy – (ACCA)

- A Bachelor of Science in Applied Accounting which is centered on the needs of employers for practical, professional accounting – BSc (Hons)

| ACCA | ||||||||||

| ACCA | Knowledge Level | Admissions in Progress* | ||||||||

| Skills Level | Admissions in Progress* | |||||||||

| Professional Level | Admissions in Progress* | |||||||||

Eligibilty: A’ Levels, Graduates or Foundation Diploma.

|

||||||||||

| ACCA offers various entry routes, depending on your age and previous academic qualifications. |

|

Relevant degree holders from ACCA-accredited institutions may be exempted from all nine exams within the Fundamentals Level and register directly at the Professional Level. Degrees with some relevance may also qualify for exemptions. For details, refer to ACCA Global Exemption Support

You have unlimited time to complete fundamental level papers and seven years to complete professional level papers. You take ACCA exams when it suits you – you choose the pace. You also have the option to select papers based on International Accounting and Auditing Standards and, in certain countries, variant papers based on local law and tax. You may also claim exemptions from certain exams, depending on what other qualifications you have gained.

| Course Duration |

| Min: 2 years On average, an individual registering with the minimum entry requirements, and studying on a full time basis would take approximately two to three years to gain their ACCA Qualification. |

You can control the speed of your progression and specialism you wish to develop. You can choose to sit either paper-based exams in March, June, September and December or on-demand Computer Based Exams (CBE) whichever suits you best. CBE are currently available for paper F1 to F4.

Computer Based Examination offers you:

|

| CBE Progression Rules for ACCA |

Students MUST be registered ACCA students prior to sitting the following papers by CBE.

|

| ACCA launches F5 – F9 Computer Based Exams in December 2016 in Pakistan |

| ACCA going to introduce ‘Session Computer Based Exams’ (Session CBEs) for papers F5 – F9 in Pakistan, starting with the December 2016 exam sitting. These CBEs have been developed after consultation with students, learning providers and employers so that they reflect the environment modern finance professionals’ work in. The use of spreadsheets and word processing programs in the CBEs ensure that the right skills and competencies are developed in students. |

| What is the exam format? |

| The exam consists of a mix of short and long questions. The Objective Test and OT Cases are auto-marked. The Constructed Response (longer) questions are where students have to produce their own narrative and numerical answers require expert/human marking. See the following ‘Exam Format’ page for full details.http://www.accaglobal.com/gb/en/student/changes-to-exams/f5-f9-session-cbe/exam-format.html |

| Students who have passed knowledge and skills modules (9-papers) of the ACCA qualification are eligible to apply for an Oxford Brookes University (OBU) Bsc (Hons) degree in Applied Accounting. Qualified members may get MBA degree of Oxford Brookes University which was specifically developed through a strategic alliance formed between the business school at the OBU and ACCA. After qualifying ACCA, you can go for CA, ICAEW, CIMA, CFA® etc; as your further career progression. |

| ACCA / Oxford Brookes University Degree Partnership |

| B.Sc. Honours Degree in Applied Accounting (Oxford Brookes University) |

| ACCA has developed a unique relationship with the UK’s Oxford Brookes University – rated top new University in 2000 for the sixth consecutive year by The Times newspaper. This valuable initiative enables students to sit for an Oxford Brookes BSc Honours degree in Applied Accounting while taking their ACCA examinations. The Oxford Brookes BSc (Hons) Degree in Applied Accounting is a highly regarded qualification, which is based on practical, professional, employer-driven accounting requirements. It enables students to prove that not only have they mastered the knowledge required for the degree, but that they have the key skills required by graduate employers. Students who are entitled to the degree are required to complete the Fundamentals Level of the ACCA qualification, the online professional ethics module and by demonstrating their research, analysis, interpersonal and IT skills by completing a Research and Analysis project. The Higher Education Commission (HEC) in Pakistan recognises the BSc (Hons) in Applied Accounting from Oxford Brookes University as equivalent to a three year bachelors degree. Students who have met the criteria outlined below will be able to apply to the HEC for recognition of their degree. For further information, refer to http://www.accaglobal.com/pakistan/students/local_information/hec |

| Masters in Business Administration (Oxford Brookes University) |

| This MBA is a unique Qualification offered to ACCA members and developed through a strategic alliance between ACCA and Oxford Brookes University. The combination of ACCA’s experience in global accountancy and the renowned quality of Oxford Brookes’ Business School has resulted in a programme designed for the international business environment of the future, fully supported online through the Virtual Campus. The MBA is accredited by the Association of MBA’s (AMBA). The MBA is internationally acknowledged to be the premier business qualification, and is AMBA accredited. By studying for MBA you will be investing in your future. And it will also be a significant step in your career development. |

- In addition to completing exams, you will need to gain relevant, supervised practical work experience.

- You can gain your practical experience before, during or after completion of the exams but ACCA strongly recommends that you gain your experience alongside or soon after sitting your exams.

- You must demonstrate effectiveness and achievement in the workplace by meeting 13 predefined performance objectives, overseen and agreed by a workplace mentor.

- Complete a minimum of three-years’ relevant practical experience.

- Record your Practical Experience Requirement (PER) in My Experience through myACCA

Please contact TIPS College information office for detailed information on tuition fees and the services we provide.

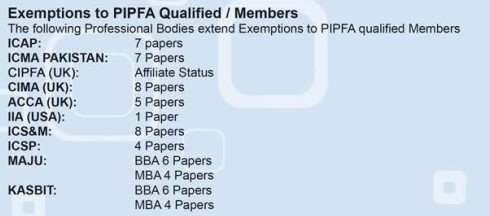

PIPFA

PIPFA is the associate member of International Federation of Accountants (IFAC), the world organization for the accounting profession. IFAC’s mission is to develop and enhance the profession to enable it to provide services of consistently high quality in the public interest. Its current membership consists of 155 professional accounting bodies in 113 countries representing more than 2.4 million accountants in practice, education, government service, industry and commerce. PIPFA, ICAP and ICMAP are the only three institutions of Pakistan having representation with IFAC.

The three sponsoring bodies – Institute of Chartered Accountants, Institute of Cost & Management Accountants and Department of Auditor General of Pakistan have continuous stakes in running the affairs of PIPFA through combined representation of 75% on the Board of Governors.

PIPFA is the associate member of International Federation of Accountants (IFAC), the world organization for the accounting profession. IFAC’s mission is to develop and enhance the profession to enable it to provide services of consistently high quality in the public interest. Its current membership consists of 155 professional accounting bodies in 113 countries representing more than 2.4 million accountants in practice, education, government service, industry and commerce. PIPFA, ICAP and ICMAP are the only three institutions of Pakistan having representation with IFAC.

The three sponsoring bodies – Institute of Chartered Accountants, Institute of Cost & Management Accountants and Department of Auditor General of Pakistan have continuous stakes in running the affairs of PIPFA through combined representation of 75% on the Board of Governors.

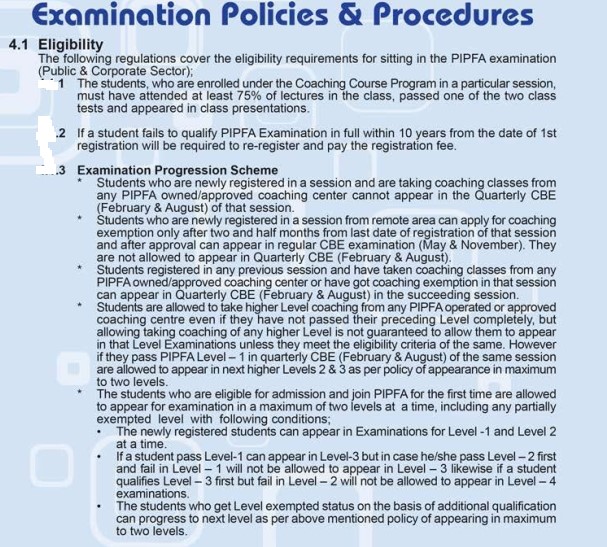

The qualification required for entry into the Corporate Sector education program is Intermediate or equivalent examination from a recognized board or foreign institution acceptable to PIPFA. Students having higher education are encouraged to join the education program and they form the large majority in the students’ strength. Those having relevant qualifications are given preference through the exemption scheme.

ELIGIBILITY FOR ADMISSION

The qualification required for entry into the Corporate Sector education program is Intermediate or equivalent examination from a recognized board or foreign institution acceptable to PIPFA. Students having higher education are encouraged to join the education program and they form the large majority in the students’ strength. Those having relevant qualifications are given preference through the exemption scheme.

REGISTRATION

To join the education program Students have to submit admission application on prescribed Registration Form along with necessary documents and fees as per the details given in the Registration Requirements.

Registration can be made any time during the year but generally students get themselves registered during November-December for the Summer Examination and during May-June for the Winter Examination.

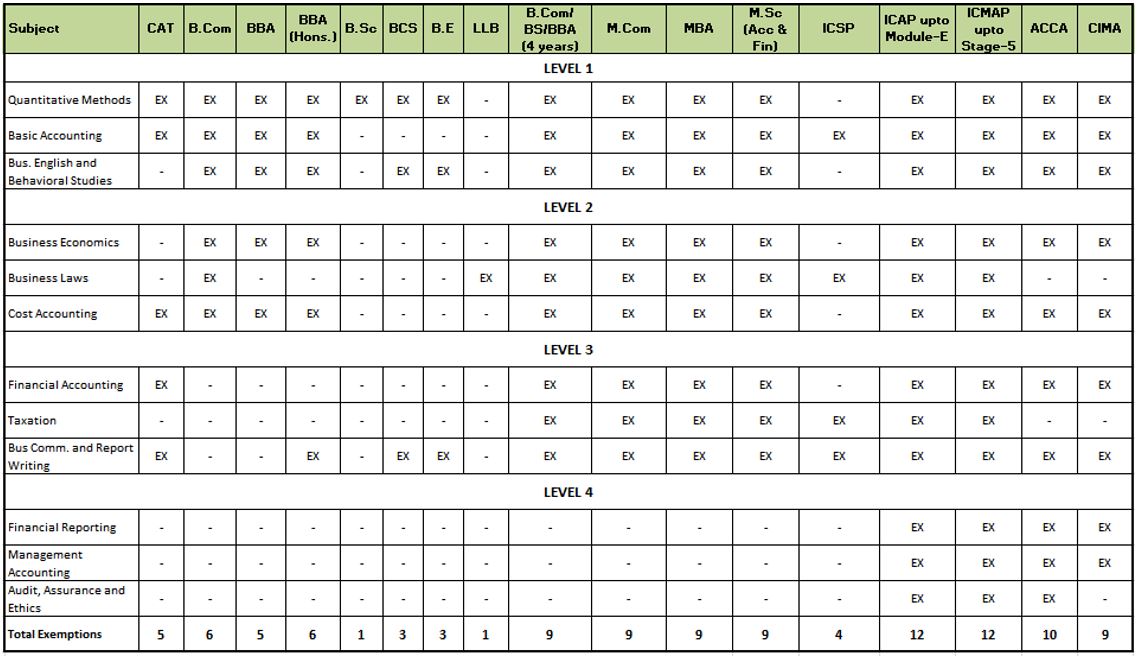

EXEMPTION FOR SOME QUALIFICATIONS

Exemptions are available on qualifying any part or paper from ICAP, ICMAP or ACCA, UK. Exemptions are also available on qualifications of MBA, M.Com, B.Com, BBA, MA (Economics), CAT, LLB, Diploma or Graduation in IT, Graduation/Master Degree with study of relevant subjects, qualifications from Corporate/Chartered Secretaries and Taxation Management institutes and other relevant qualifications. Details of Exemption are separately given.

This value added combination of professional qual9ificaiton & commerce graduations recognition mark for The TIPS. The foundation offers 2 qualification in 2 years side by side. It is expertise of the management that they enable the students to utilize their 2 years in an effective manner. A student who comes at The TIPS after intermediate will be an associate professional accountant (APA) , commerce graduate (B.Com) and C.A (Foundation) after spending 2 years at place of excellence because a PIPFA qualified student will be exempt from CA (Foundation).

Why PIPFA + B.Com Should be preferred?

• Exemption of CA Foundation

• Cost Savings Through PIPFA.

• No PPT / Entry Test.

• After PIPFA eligibility for any Government Job.

• Commerce Graduation (B.Com) with PIPFA in 2 Years.

• Preparation for remaining CA Examination

Subjects

| Level-1 | Level-2 |

| Quantitative Methods | Business Law |

| Basic Accounting | Economics |

| Business English & Beh. Studies | Cost Accounting |

| Level-3 | Level-4 |

| Financial Accounting | Financial Reporting |

| Taxation | Management Accounting |

| Business Communication & Report Writing | Audit, Assurance & Ethics |